Contractor vs. Employee – A Guide to Avoiding Misclassification

Sept 28, 2023. SourceCandidates

Navigating Employment: Independent Contractor vs. Employee – A Guide to Avoiding Misclassification

In today’s evolving workforce, understanding the distinction between a Contractor vs. Employee is crucial for businesses. Misclassification can have costly consequences, including legal ramifications. This post aims to shed light on the differences between the two, provide a checklist to avoid misclassification, discuss the hiring risks, and present a solution to reduce such risks by utilizing SourceCandidates as an Employer of Record.

Independent Contractor vs. Employee: The Basics:

Before diving into the checklist and the risks involved, let’s clarify the fundamental differences between an employment contractor and an employee.

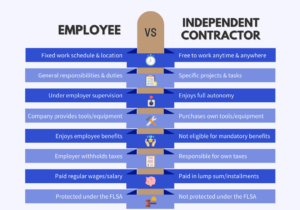

- Employee:

- Works under the direct control and supervision of the employer.

- Typically receives benefits such as healthcare, paid leave, and retirement plans.

- Taxes are withheld from their paychecks.

- Generally enjoys job security and long-term commitment.

- Contractor:

- Works on a project or contractual basis.

- Has more independence and control over their work.

- Responsible for their taxes and benefits.

- Often hired for short-term or specialized tasks.

Checklist to Avoid Misclassification:

Misclassifying workers can result in legal trouble and financial penalties. To ensure proper classification, consider the following checklist:

- Nature of the Work: Assess whether the individual has control over their tasks or follows company directives.

- Work Schedule: Determine if the worker sets their hours or adheres to the company’s schedule.

- Benefits and Taxes: Confirm if the worker receives company benefits and has taxes withheld.

- Equipment and Expenses: Analyze who provides tools, equipment, and covers work-related expenses.

- Duration: Assess whether the relationship is ongoing or project-based.

- Training and Supervision: Evaluate the level of training and supervision involved.

- Exclusivity: Determine if the worker is exclusive to your company or can work with others.

- Contract: Have a written contract outlining the worker’s status, responsibilities, and terms.

Hiring Risks and Consequences of Misclassification of Independent Contractor vs. Employee:

Misclassifying workers can lead to several risks and consequences:

- Legal Liabilities: Violations of labor laws can result in penalties and fines.

- Back Taxes: If taxes aren’t withheld properly, the employer may owe back taxes.

- Benefits Claims: Misclassified workers may claim entitlement to benefits and protections.

- Damaged Reputation: Reputational damage can impact a company’s image.

- Employee Turnover: Employee morale can suffer if they perceive unfair treatment.

SourceCandidates: Reducing Hiring Risk and Liability: To mitigate the risks associated with worker misclassification, consider leveraging SourceCandidates(backed by Stemta Corporation) as an Employer of Record (EOR). Here’s how this solution reduces hiring risk and liability:

- Expertise: SourceCandidates has the expertise to correctly classify workers, ensuring compliance with labor laws.

- Payroll and Benefits: The EOR handles payroll, benefits, and tax matters, reducing administrative burdens.

- Risk Mitigation: SourceCandidates assumes the legal responsibility for workers, minimizing your liability.

- Flexibility: Utilizing an EOR allows you to access specialized talent without the complexities of traditional employment.

In the ever-changing landscape of employment, distinguishing between an employment contractor and an employee is vital. Misclassification can lead to legal troubles and financial burdens. To avoid these risks and streamline your hiring process, consider partnering with SourceCandidates and Stemta Corporation as an Employer of Record. You can then confidently navigate the complexities of worker classification, reduce liability, and focus on what truly matters – your business’s growth and success.